LC Real Estate Group’s Special Asset Services Team is a full-service real estate advisor that provides highly skilled brokerage services to homeowners looking to preserve the equity in their home. We have experience working with homeowners in the foreclosure process and dealing with special situations including Chapter 13 Bankruptcy and Short Sales. We are adept at running sales and marketing programs in difficult and high-pressure situations when properties must sell within a given timeline and can also assist in finding sale alternatives. We have a licensed support team and administrative support staff that is able to provide a high level of customer service.

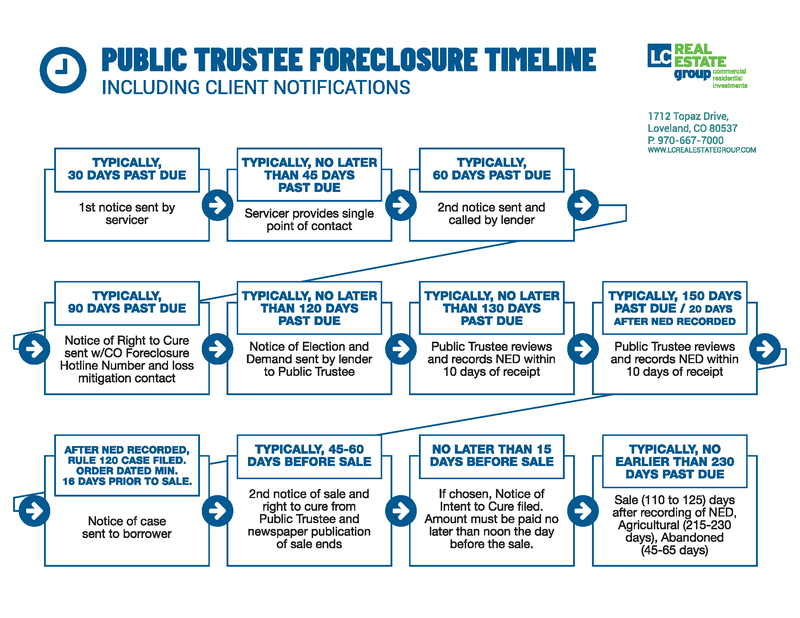

For a non-judicial foreclosure, the public trustee must publish the sale a minimum of five (5) times in four (4) consecutive weeks in the local newspaper of record ending 45-60 days before the sale. The borrower must file a Notice of Intent to Cure a minimum of 15 days prior to the scheduled sale date. The lender’s attorney schedules a Rule 120 Hearing to occur prior to sale, which the borrower may attend. If the borrower does not respond when given notice, the judge may cancel the hearing and sign the order allowing the sale. The borrower will then receive figures within seven (7) days of the scheduled sale date with the total amount necessary to reinstate the loan. The total amount must be paid by cashier’s check or other certified funds no later than noon the day before the sale. For additional information regarding your specific situation, you should seek professional legal counsel.

Yes. If the debt owed on the property is greater than the proceeds from the foreclosure sale, in which case the lender may seek a deficiency judgment from the court. If a deficiency judgment is granted, the borrower may owe the difference to the lender. In Colorado, the lender can obtain a deficiency judgment after a nonjudicial foreclosure by filing a separate lawsuit within six (6) years. Deficiency judgment: (Colo. Rev. Stat § 4-3-118)

The lender/servicer, the lender’s attorney, the public trustee, and the borrower are all involved. Other parties that may be involved include attorneys retained by the borrower, the court, a real estate broker, housing or credit counselors, public assistance organizations, and the sheriff’s office.

Avoid solicitations that guarantee modifications will be made or foreclosure will be halted, ask for fees in advance, recommend the borrower to stop making loan payments, or recommend not to speak with a lender. For additional information visit: https://www.stopfraudcolorado.gov/

This act was created in 2006, among other things, to provide each homeowner with information necessary to make an informed and intelligent decision regarding transactions with certain foreclosure consultants and equity purchasers, to provide certain minimum requirements for contracts between such parties, including statutory rights to cancel such contracts, and to ensure and foster fair dealing in the sale and purchase of homes in foreclosure. Specific form contracts including the Contract to Buy and Sell Real Estate (Colorado Foreclosure Protection Act), Seller Warning-Equity Skimming (SWF30) and Notice of Cancellation (NCF34), Homeowner Warning Notice – Right to Cancel (HWN65) may be required as part of any sale transaction. §6-1-1101 et. Seq., C.R.S.

If you property is not your principal residence then it may be sold as a short sale. If your property is a commercial property, is not more than 30 days delinquent or in default, or if the seller has a right to lease the property after closing, a right to repurchase the property, or if the buyer will be required to assume a portion of the sellers loan then it may not be covered by the Colorado Foreclosure Protection Act and an attorney may need to prepare the sale contract.

Homeowners may stop doing business with a Brokerage at any time, option to accept mortgage assistance, payment of brokerage fees, stopping mortgage payments could be damaging to credit.

SHORT SALE ADDENDUM (Seller Listing Contract)

The borrower will have to pay all lender foreclosure costs and fees including legal fees, typically $2,500 or more, back payments, and late fees. For additional information regarding your specific situation, you should contact your lender.

A short sale is when a lender or lien holder agree to a sale of a property for less than what is owed. Benefits of a short sale include avoiding foreclosure, financial hardship to borrower may be less severe, short sale may be less damaging to a credit score than a foreclosure, some sellers may be eligible to get a new loan for a different property, and additional legal and foreclosure expenses can be avoided that may need to be repaid by borrower. Specific form contracts include the Short Sale Addendum to both the Seller Listing Contract and Contract to Buy and Sell Real Estate. For additional information regarding your specific situation, you should seek additional professional counsel. §6-1-1121, C.R.S.

Most often a lender will report a short sale to a credit agency as Settled, where the loan is satisfied and an agreement between the lien holder and the borrower was reached. In some cases, the lender will report a Charge-Off, in which case the loan has been written off as a loss and further collection action may be taken. The borrower may still owe taxes on the sale as a capital gain on the difference between the loan balance and the payoff amount. If the transaction is not completed prior to a foreclosure the seller may not have the right to transfer the property. Short sales are conditional upon lender or lien holder approval. All lenders or lien holders must approve the sale and closing may be delayed. If you have other assets including other properties, stocks, or a high income, the lender or lien holder may not agree to a short sale. For additional information regarding your specific situation, you should seek additional professional counsel.

Having a contract on your property will not delay your foreclosure. In order to delay a foreclosure you will need a written agreement with the lender with terms agreed to by both parties. If you have a purchase contract on your home that will satisfy the outstanding debt being foreclosed upon you may have a greater chance of success with getting a written agreement to delay foreclosure. If you want to avoid a foreclosure but do not have enough equity to satisfy the amount being foreclosed upon you may be able to complete a short sale agreement with the lender to sell the home on the market. For additional information regarding your specific situation, you should seek additional professional counsel.

When you file for either Chapter 7 or Chapter 13 Bankruptcy, the court will place what's called an "automatic stay" on any debt you owe and on any foreclosure proceedings against your home. This means that any debt collectors have to quit calling and the sale of your home is temporarily placed on hold. The lender, however, can petition the court to have the stay removed from a planned foreclosure so the time extension may not last long. The lesser the amount of equity you have in. your home the less likely the court and the lender are likely to agree to an extension of time.

Under Chapter 13, all of your debts are consolidated into one lump-sum debt with a set monthly payment to be satisfied under a 36 to 60-month repayment plan. If your mortgage is included in this amount, it would leave the property in your hands so long as you continue to make regular payments every month.

Chapter 7 Bankruptcy is a liquidation plan that allows the appointed bankruptcy trustee to sell your non-exempt assets to pay off your creditors. Your home is exempted under homestead protection, but only up to a certain amount. Equity up to $75,000 is exempted, but that figure rises to $105,000 if you or your spouse is disabled or 60 years of age or older. You can continue to make your mortgage payments and stay in your home so long as your are current or make up any past-due amount if your equity does not exceed the amounts stated above. If your equity exceeds those amounts above, you will have to make up the difference. For additional information regarding your specific situation, you should seek additional professional counsel.

Deeds of trust are foreclosed on by the public trustee for the county; and HOA Liens and mortgages are a judicial process for the county in which the property is located.

A Foreclosure Consultant is a person who does not, directly or through an associate, take or acquire any interest in or title to a homeowner’s property. This person, and who in exchange for compensation from the homeowner or from the proceeds of any loan or advance of funds, provides a service that will assist the homeowner with their foreclosure. This assistance may include stopping or postponing a sale, obtaining a forbearance or loan extension, assisting in curing a default, obtaining a waiver of an acceleration clause, or assisting the homeowner with obtaining a loan or advance of funds, or avoiding or reducing an impairment of the home owner’s credit. A licensed real estate broker is not considered to be a Foreclosure Consultant. For additional information regarding your specific situation, you should seek legal counsel.

We recommend you seek expert assistance regarding your foreclosure. One of the best resources available is the Colorado Foreclosure Hotline, which can be reached at (877) 601-4673.

Colorado Housing Connects is a resource where you can speak with a HUD approved housing counselor. A housing counselor can assist you when it comes to foreclosure prevention and if you are behind on your housing payment or worried about falling behind. For additional information visit: https:/coloradohousingconnects.org

Colorado Legal Services (CLS) is a non-profit organization that helps low income individuals and seniors seeking assistance with civil legal needs including foreclosure. Locate the phone number for the county you live in by visiting: https:/coloradolegalservices.org

If you are a veteran regardless of whether or not you have a VA loan and are facing foreclosure or homelessness, you can reach additional assistance at (877) 827-3702. The national call center for homeless veterans is (877) 424-3838. For additional information visit: https://www.hud.gov

If you financed your home through the Federal Housing Administration (FHA) and have an FHA loan, and you are facing foreclosure or homelessness, you can reach additional assistance at: (800) 225-5342. https://www.hud.gov

If you are facing foreclosure, we can provide real estate brokerage services including free opinion of value, discounted contract writing assistance and sale management, and full service traditional and short sale brokerage services.

(720) 357-3948

michael@lcrealestategroup.com